Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Wonder why a custodian does not try to take over this company?

OK. I traded this stock about 10

years ago left this one free and clear

I can’t either… not until they get pink current again on otc markets. I have shares from long ago. Hoping for a revival or custodianship

Where do you buy iprc td won't let me buy shares

How about a custodianship here? This company clearly is not taking steps to do anything. They have oil assets and would be a great merger candidate. Shareholders are tired of the company doing nothing in an age where many expert market OTC companies are taking steps to get current,

Maybe it’s time for someone else to take control of this company so that they can actually do something productive

Nit that I no of I tried taking a position threw td no ho

I am watching this one too

Is there a brokerage selling any ?

No I haven't but I just did . Might have to jump back in here .

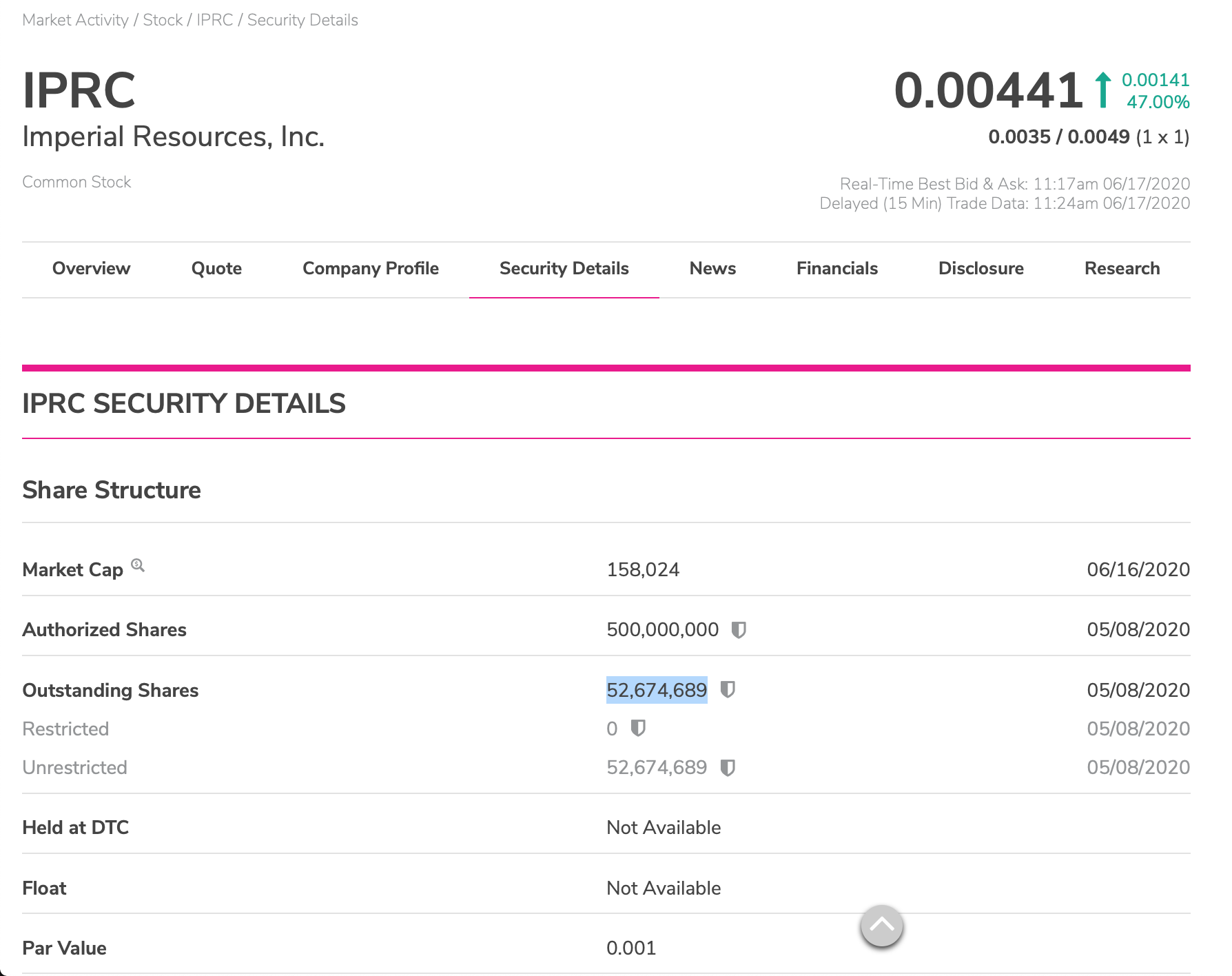

My god- have you even looked at the share structure for IPRC?

It can be found at:

https://www.otcmarkets.com/stock/IPRC/security

The unrestricted share count is 60,782,660, with authorized shares at 500,000,000

Why would anyone even want to do a reverse split with this type of share structure? With s share structure this low, the paperwork alone would cost more than the benefit of doing a reverse split.

My god- please at least look at the share structure before making statements about reverse splits. There are plenty of diluted OTC pigs that could benefit from a reverse split. This stock is not one of them

Your right but a lot of them sure do . Iprc was a favorite of mine a few years back . I was surprised to see it drop so low .

No proof of that. That’s opinion only.Gotta get current first regardless

Does every gray stock that gets current automatically reverse split? The answer is no

They all will eventually- it’s the cycle of the OTC

Does anyone thin IPRC will come alive again?

Something is definitely going on behind the scenes. $IPRC has fallen off the radar for most people.

Biggest volume day yesterday. Volume before price. Could be a big mover here.

Someone posted something on twitter saying they texted the CEO and he responded saying they were looking into the new OTC reporting requirements. Might be something going on behind the scenes.

Great share structure. why is the share price so low here?

Found this website is this us:

https://www.imperialresources.ph/

SS updated and still same. Last was 2/5/21 and just updated showing no SS change. 60mil OS remains.

How dare this get any buy volume 02 level. We must put up big walls to stop this lol. I'll be patiently waiting for the bulls to run the show

I'm all for it let the break out begin and the sooner the better.

Ask is nice and thin today. Looks like a good amount of folks are loaded heavy and ready for the breakout

I am and added some to it. GLTY

$IPRC 023 has been resistance last few days. Break it and force the shorts to cover on the ask.... feeling a nice ride north coming this week$$

You still holding? Looks like next weekend could get interesting

$IPRC great volume today with a great ss here! Bet this runs next week. Ask really thinned out throughout the day$$

any predictions or words on when, IPRC are going to post any

financial updates soon? to bring this current and get

rid of the stop sign??

That was over two months ago. In October, CFGN added 5M to the OS, left by the end of October and has not been seen on the ask since. My guess is that since the owner recently paid and updated the Transfer Agent, that they had to clean up some outstanding shares. Was likely a holdover from a long time ago. Two months have passed without another share being added. OS remains 58M. Also note that there are no restricted shares in the OS. All unrestricted, free-trading.

So apparently they added 5 million more to o/s is there a reason why? Notes converting ?

$IPRC could legitimately hit $1 if the directors play this one right.

Nice action today, here are a few notes:

08.31.20 Annual list filed

06.04.20 Form 15 filed a few months back

Following this revival story since the Summer. Looking great here. 52M OS. Reputable directors. Gas/Oil/Energy sector.

I am loving how this is coming together. This could be a .10+ stock soon. CEO doing everything right: reinstatement, OTCM profile update, TA paid and updated. Directors do not go to that trouble and expense for nothing.

Expecting now they will go Pink Current on OTCM and a shareholder update next...

Congrats longs! Much more to come...

PPS on dramatic rise here. Cant see any reason why...hope good news is to come!

Yep, bid is already at 1.5 cents.

I mean this one has the potential to be a 10 bagger from these levels still, so not a bad idea to get in under 2 cents.

Yeah I seen that probably late wanted to be a little earlier

Going to be tough to get filled here

I want a bunch but the ask is dry someone fill me if I raise the bid or what?

Dry. New base at .01. Ready for liftoff.

$IPRC shaping up nicely for a solid 2020 close

Only 52 million O/S, this thing will run fast!

52 week high got shattered yesterday. The run is just beginning!

This will be the next 10 bagger on the OTC.

That's a good point as well! There definitely could be an Oil&Gas company seeking R/M for funding...pure speculation here but excited to see what happens!

$IPRC

|

Followers

|

34

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

1236

|

|

Created

|

11/28/10

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |