Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

$EPAZ Bids building watching for more updates!

Same pictures from the Arizona show last year.This is going nowhere.They haven't made one sale,zero.Same bull crap everyday with no results.Good luck and good trading.

Zena Epaz ready to meet Wallstreet.... 15 days!

I would prefer that they ascended to a new high on EPAZ stock price after signing a nice military contract with somebody.

$EPAZ #Zenadrone1000 is at the #FIDAE2024 to showcase its capabilities

to the US Ambassador to Chile, Bernadette Meehan!

The Zenadrone team presented cutting-edge features as they ascended to new heights, bridging nations and shaping the future of innovation.

#ZenaDrone #dronetech

#Zenadrone1000 is at the #FIDAE2024 to showcase its capabilities

— ZenaDrone_Inc (@ZenadroneInc) April 11, 2024

to the US Ambassador to Chile, Bernadette Meehan!

The Zenadrone team presented cutting-edge features as they ascended to new heights, bridging nations and shaping the future of innovation.#ZenaDrone #dronetech pic.twitter.com/WNBNR7tNpH

is a market with small burst of bullish episodes not the bonanza of runners we used to see before the new sec rules of 2021

Maybe the calm before the storm

EPAZ

EPAZ gonna fly drone stock

Market is bullish on Small Cap, I'm bullish on EPAZ. When all fog is clears I say EPAZ is easily x 20-30 times from here if they stop diluting.

LOLOL that's what it must be couldn't be that nobody's interested in this Flying Pig could it? What are they going to spin off there's nothing to spin off and the only reason this a****** would spin off something just to create another public vehicle for him to go ahead and sell more Stockton to the market. This is a nothing Burger

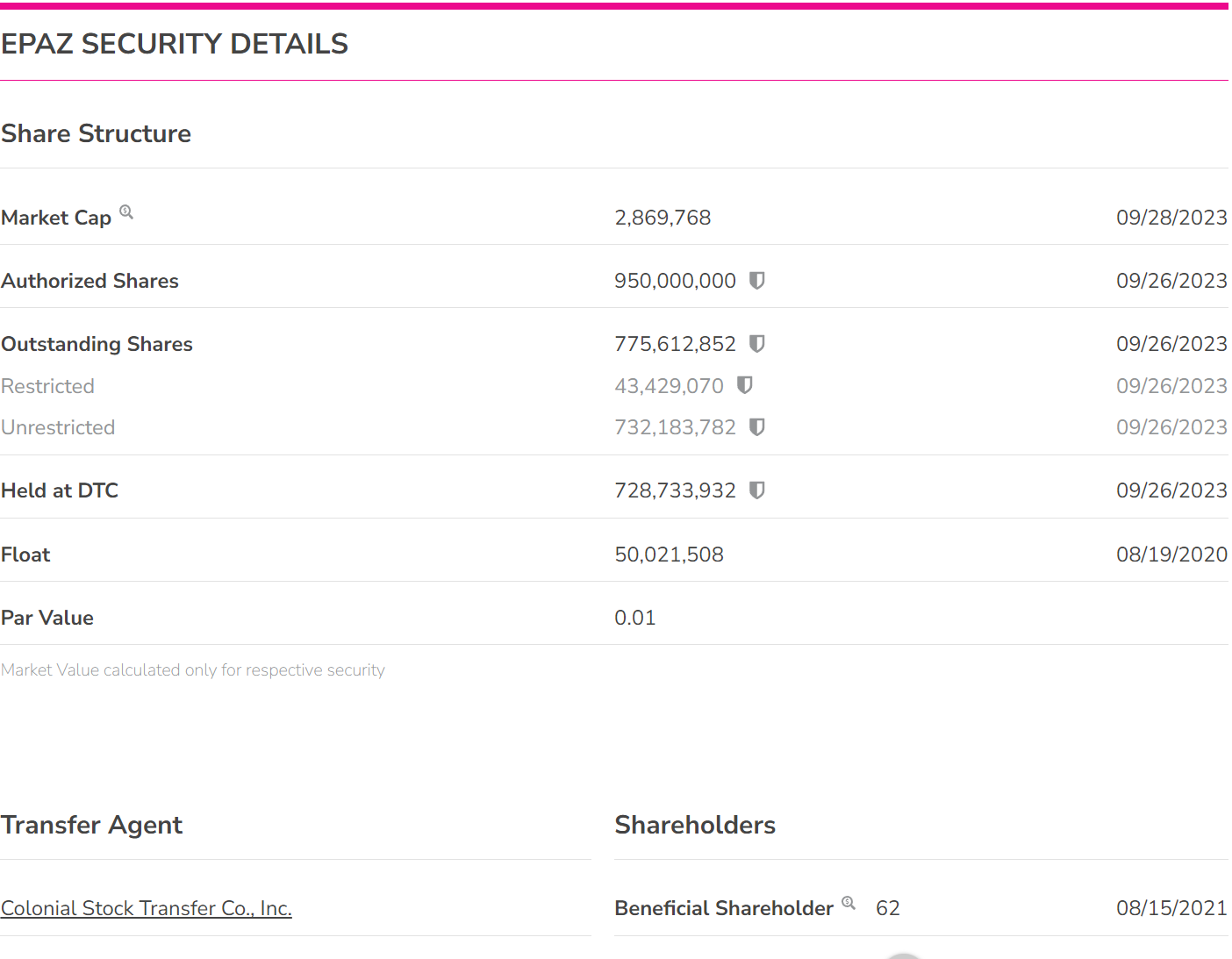

$EPAZ Security Details: https://www.otcmarkets.com/stock/EPAZ/security

Could the absence of information for current shareholders be due to a “quiet period” regarding the spinoff?

As they say: "I'd like to see it ... ". GLTY.

What is the straight benefit to EPAZ shareholders? Talk to me.

April 30, for the Listing. ZENA ATTENTION!

Nice update

Zena EPAZ SOLAR bitcoin miners... Fall 2024

BTC should be over 200K...by then

https://www.otcmarkets.com/stock/EPAZ/news/EQS-News-Epazz-Inc-CryObo-Inc-Technology-Converts-Solar-Power-into-Bitcoin-Projects-to-Launch-Later-This-Year?id=436215

Form F-1/A ZenaTech, Inc.

https://www.streetinsider.com/SEC+Filings/Form+F-1A+ZenaTech%2C+Inc./23051685.html

$EPAZ CryObo technology uses solid-state batteries to store sunlight to power Bitcoin servers. #Bitcoin #bitcoinstocks #blockchain #solidstatebatteries

$EPAZ CryObo technology uses solid-state batteries to store sunlight to power Bitcoin servers. #Bitcoin #bitcoinstocks #blockchain #solidstatebatteries

— Epazz, Inc. Ticker: $EPAZ (@epazz) April 11, 2024

Shaun Passley, Ph.D., Epazz Inc. CEO and chairman, said, We are excited about bringing the CryObo technology into operations. With this technology, Epazz will be a research and development company that will be bringing technology into the market and will be spinning off a few companies.

All they ever brought into the market and all they ever will bring into are paperlapap and tons of shares made by dilution

I sleep all night very peacefully

Ugh naw I bought propyusd ....propyusd is a real world asset token....

Epaz has over 2 million in revenues...and growing!

https://www.otcmarkets.com/stock/EPAZ/news/EQS-News-Epazz-Inc-CryObo-Inc-Technology-Converts-Solar-Power-into-Bitcoin-Projects-to-Launch-Later-This-Year?id=436215

Asset Tokenization is being adopted ... by everyone.

AI is being adopted by ...everyone.

AI blockchain is being adopted by ...everyone.

Think market cap trend.

Liquidity is being created driving market cap logarithmic growth.

Blockchain/crypto assets scale logarithmicly as tokenization happens.

This logarithmic growth is revaluating tangible assest , inflating market caps.

Global Realestate & Crops alone will add Trillions of liquidity to the global economy stimulating prosperity ...

Especially for those invested in core infrastructure stocks like little epaz...imho

Solar to btc time.... epaz!

https://www.otcmarkets.com/stock/EPAZ/news/EQS-News-Epazz-Inc-CryObo-Inc-Technology-Converts-Solar-Power-into-Bitcoin-Projects-to-Launch-Later-This-Year?id=436215

Yes , You said it all right,

however, with cryto you can't sleep very peacefully, because it's very unstable and we've seen that several times before..

Crypto will make new millionaires no questions about it, but also many will get sick because of stress, believe me. You never know what's going to happen next hour.

Day and night trading... insane. A lot of people got lost in this.

We've been seeing for over 2yrs from pennies now trippppppy trippppppppppps

Cry waiting on this turd while billions are made with BlackRock and JP Morgan in crypto.... There's a reason why there's no institutions involved in this dumpster fire....OTC is for old farts that can't adapt....More inflation less available liquidity for OTC tickers...Learn economics 101

Just a buying opportunity...the future is epaz zena... you will see

anyway Al;l Crypto is just a scams .....the digital value, for what .... air ? what a fraud... lol

The Scam of the Century!

Dead good luck...There are still a few OTC tickers running while there are lots of Altcoins in crypto running...

And nothing here ...If you like Bitcoin just buy crypto or a miner stock...You keep posting and more red rum pps

Excellent been mainly in crypto pand away from scams like this one lol

$EPAZ established Galaxy Batteries, Inc. as the vehicle to advance its intellectual property in the domain of solid state battery tech. Their forward-looking approach continues as they anticipate additional patent filings related to the technology. Dr. Shaun Passley, CEO of Epazz, expressed enthusiasm for the progress made by Galaxy Batteries, highlighting the intent to prioritize the subsidiary’s development. This could pave the way for Galaxy Batteries to flourish as a standalone entity in the future. https://ytech.news/en/galaxy-batteries-inc-forges-ahead-with-cutting-edge-ai-solid-state-battery-patent/

AssetTokenization=TheNext BigThing!

EPAZ - dilution suckers.

EPAZ SOLAR TO BTC...ON!

Nice news today

Btc 70K,

There ready to advance on all fronts...

https://ytech.news/en/galaxy-batteries-inc-forges-ahead-with-cutting-edge-ai-solid-state-battery-patent/

more then 4 M dumped .... nice lol

$EPAZ Galaxy Batteries Solid state batteries are gaining traction owing to their higher energy density, increased safety, and longer lifespan compared to traditional lithium-ion batteries.

Read More Here:

https://bit.ly/3PQLo60

$EPAZ Galaxy Batteries Solid state batteries are gaining traction owing to their higher energy density, increased safety, and longer lifespan compared to traditional lithium-ion batteries.

— Epazz, Inc. Ticker: $EPAZ (@epazz) April 9, 2024

Read More Here:https://t.co/5KbTbX3BAn pic.twitter.com/2UHR51njth

$EPAZ NEWS: Epazz, Inc.: CryObo, Inc. Technology Converts Solar Power into Bitcoin Projects to Launch Later This Year

NewMediaWire

Tue, Apr 9, 2024, 8:30 AM EDT

In This Article:

EPAZ

+17.82%

CHICAGO, IL - (NewMediaWire) - April 09, 2024 - Epazz Inc. (OTC Pink: EPAZ), a mission-critical provider of battery solar technology, drone technology, blockchain cryptocurrency mobile apps and cloud-based business software solutions, announced today that its subsidiary CryObo, Inc. has been working on using solar power to mine bitcoins. Epazz has been developing solid state battery with its subsidiary Galaxy Batteries, Inc. and has been working on solar power for its drone charge pad technology. The Company has been working on combining the technology into an integrated solution to mine bitcoins in Dubai, where it has manufacturing facilities. The Company will be securing a desert land in a remote area of Dubai to set up the facility. CryObo will use high-power computers to mine the bitcoin. The solar power technology that the project will be using points the solar panels directly at the sun and rotates them to capture the maximum amount of energy from the sun. The energy will be stored in Galaxy Batteries. The bitcoin server will be located underground, using plant cover to naturally cool the servers.

With bitcoin over $70,000, now is the best time to bring the technology into operations. CryObo technology will not enter the United States or Canada markets. All of our crypto and blockchain projects will be outside of these countries. The Company will be focusing on the Middle East, Europe and Asia markets, whose regulations are clear.

Shaun Passley, Ph.D., Epazz Inc. CEO and chairman, said, "We are excited about bringing the CryObo technology into operations. With this technology, Epazz will be a research and development company that will be bringing technology into the market and will be spinning off a few companies."

About CryObo Inc.

CryObo Inc. will be enhancing its software to give early access to companies backed by tangible assets an easy way to access the token markets. The company's platform will change how people transact real estate, digital assets, corps and raw materials by allowing companies to access the future value of their assets. The growth of bitcoin and other cryptocurrencies is bringing new regulations for large financial service companies, which will require an intelligent solution to manage their growing portfolios.

About Epazz Inc. (www.epazz.com)

Epazz Inc. is a leading cloud-based software company specializing in providing customized cloud applications to the corporate world, higher-education institutions and the public sector. Epazz BoxesOS v3.0 is the complete business web-based software package for small to midsize businesses, Fortune 500 enterprises, government agencies and higher education institutions. BoxesOS provides a combination of many web-based applications that an organization would otherwise need to purchase separately. Epazz's other products are DeskFlex (room scheduling software) and Provitrac (applicant-tracking system).

SAFE HARBOR

The "Safe Harbor" Statement under the Private Securities Litigation Reform Act of 1995: Certain statements contained in this press release are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally can be identified by the use of forward-looking language, such as "may," "expect," "intend," "estimate," "anticipate," "believe" and "continue," the negative thereof or similar terminology. Such forward-looking statements are subject to risks, uncertainties and other factors that could cause the actual results to differ materially from future results or those implied by such forward-looking statements. Investors are cautioned that any forward-looking statements are not guarantees of future performance, and actual results may differ materially from those contemplated by such forward-looking statements. Epazz Inc. assumes no obligation and has no intention of updating forward-looking statements. It has no obligation to update or correct information prepared by third parties that are not paid for by Epazz Inc. Investors are encouraged to review Epazz Inc.'s public filings on SEC.gov and otcmarkets.com, including its unaudited and audited financial statements and its OTC Markets filings, which contain general business information about the results of its operations, and risks associated with the company and its operations.

Contact

For more information, please contact

Investor Relations

investors@epazz.net

312-955-8161

www.epazz.com

[Annual] Report

For the period ending [December 31, 2023] (

Total assets $ 4,992,623

https://www.otcmarkets.com/otcapi/company/financial-report/397109/content

https://www.otcmarkets.com/market-activity/news

More ducks in a row...

Ammend Financials

$Epaz

They talk the talk ... for 10-20 C by now.

When will anything they SAY they are doing be worth .01/share?

|

Followers

|

430

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

74062

|

|

Created

|

01/22/08

|

Type

|

Free

|

| Moderators solidgold jedijazz SkyPilotUSA | |||

Epazz, Inc.

Pink Current Information

CHICAGO, IL - (NewMediaWire) - April 2, 2024 - Epazz, Inc. (OTC: EPAZ), a mission-critical provider of drone technology, battery technology, artificial intelligence processes, blockchain mobile apps and cloud-based business software solutions, announced today the company's subsidiary, Galaxy Batteries, Inc., has filed its second patent on artificial intelligence solid state battery technology.

AI solid state battery technology uses a unique chemistry to achieve high-density and high-voltage batteries along with its battery management system that gathers data from the environment including wind speed, humidity, temperance and pressure to predict the best output for the system to perform to maximum flight time for drones and electric airplanes.

Epazz has formed Galaxy Batteries, Inc. to house its intellectual properties for solid state battery technology. Epazz has been working on special battery technologies for high-powered devices and aircrafts. Epazz is in the process of filing additional patents for its battery technology in the coming months and believes that in the future Galaxy Batteries can become an independent company.

CEO Shaun Passley, PhD, said, "We are excited to file our second patent for Galaxy Batteries, as we begin to focus resources toward this company."

About ZenaDrone, Inc. (https://www.zenadrone.com/)

ZenaDrone, Inc. is dedicated to improving its intelligent unmanned aerial vehicle technology, which uses machine learning software and AI. ZenaDrone, Inc. began with the goal of revolutionizing the hemp farming sector and later evolved into an intelligent and multifunctional industrial surveillance, inspection and monitoring solution.

About Epazz, Inc. (https://www.epazz.com/)

Epazz, Inc. is a leading cloud-based software company that specializes in providing customized cloud applications to corporate companies, higher education institutions and the public sector. Epazz BoxesOS(TM) v3.0 is a complete web-based software package for small and mid-sized businesses, Fortune 500 enterprises, government agencies and higher education institutions. BoxesOS(TM) provides many of the web-based applications organizations would otherwise need to purchase separately. Epazz's other products include DeskFlex(TM) (a room-scheduling software) and Provitrac(TM) (an applicant-tracking system).

SAFE HARBOR

This safe harbor statement is made under the Private Securities Litigation Reform Act of 1995.

Certain statements contained in this press release are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can generally be identified by their use of words such as "may," "expect," "intend," "estimate," "anticipate," "believe," "continue" (or the negatives thereof) or similar terminology. Such forward-looking statements are subject to risks, uncertainties and other factors that can cause actual results to differ materially from predicted results or those implied by such forward-looking statements. Investors are cautioned that forward-looking statements are not guarantees of future performance, and actual results might differ materially from those suggested by such statements. Epazz, Inc. assumes no obligation and has no intention of updating these forward-looking statements, and it has no obligation to update or correct information prepared by third parties that is not paid for by Epazz, Inc. Investors are encouraged to review Epazz, Inc.'s public filings on SEC.gov and otcmarkets.com, including its unaudited and audited financial statements and its over-the-counter market filings, which contain general business information about the company's operations, results of its operations and the risks associated with the company and its operations.

Contact

Investor Relations

312-955-8161

CHICAGO, IL, March 27, 2024 (GLOBE NEWSWIRE) -- via NewMediaWire -- Epazz, Inc. (OTC Pink: EPAZ), a mission-critical provider of solid-state battery technology, drone technology, blockchain mobile apps and cloud-based business software solutions, has announced today that its subsidiary Galaxy Batteries, Inc., a trailblazer in solid-state battery technology, is proud to announce the opening of its new manufacturing site, a testament to the company’s unwavering commitment to innovation and sustainability.

The new facility is in Sharjah City, United Arab Emirates, and represents a significant milestone for Galaxy Batteries, Inc., as it continues to lead the charge in developing products for the drone and aerospace market.

“Our new manufacturing facility is to manufacture our solid state battery for drones and eVTOLs,” said Shaun Passley, Ph.D., CEO of Epazz, Inc.

For more information about Galaxy Batteries, Inc. and our sustainable initiatives, please visit https://www.galaxybatteries.com.

About Galaxy Batteries, Inc.: Galaxy Batteries, Inc. is a manufacturer of solid-state battery solutions.

About Epazz, Inc.

Epazz, Inc. is a mission-critical provider of Metaverse solutions, blockchain cryptocurrency mobile apps and cloud-based software. It is a company that specializes in providing customized cloud applications to corporate firms, higher-education institutions and the public sector. Epazz is developing Metaverse business solutions, enabling people to collaborate through VR in real time. Epazz is upgrading its business solutions to be fully integrated into the Metaverse, for which it will be manufacturing low-cost smart glasses.

$EPAZ CEO Dr. Shaun Passley on March 6th Press Release:

"We are thrilled to have been selected by the Air Force for this prestigious contract and are eagerly working on the proposal for Phase 2," stated Dr. Shaun Passley, CEO of Epazz, Inc. "This contract not only validates our technological advancements but also opens up numerous opportunities for future growth and collaboration with government agencies."

ZenaDrone 1000 taking off charging pad

CHICAGO, IL, March 06, 2024 (GLOBE NEWSWIRE) -- via NewMediaWire – Epazz, Inc. (OTC Pink: EPAZ), a mission-critical provider of drone technology, blockchain mobile apps, and cloud-based business software solutions, has announced today that its holdings company ZenaDrone, Inc., a company known for its patented vertical take-off and landing (VTOL) drone technology, announced today, has successfully secured additional funding from the contract with the United States Air Force. The company is currently developing its Phase 2 proposal for the project and is expecting a substantial revenue increment from the contract.

This contract signifies an important milestone for ZenaDrone in the unmanned aerial vehicle (UAV) sector and highlights the advanced capabilities of its drone technology. The contract aligns with ZenaDrone's commitment to fostering innovation in aerial surveillance and reconnaissance.

"We are thrilled to have been selected by the Air Force for this prestigious contract and are eagerly working on the proposal for Phase 2," stated Dr. Shaun Passley, CEO of Epazz, Inc. "This contract not only validates our technological advancements but also opens up numerous opportunities for future growth and collaboration with government agencies."

Epazz, Inc. believes that this contract will strengthen ZenaDrone’s position in the market for Unmanned Aerial Vehicle technology and attract further interest from investors and other government agencies, including the US Navy. It represents a significant triumph for domestic drone technology and reinforces the importance of innovation and technological excellence in securing national contracts.

About ZenaDrone Inc. (https://www.ZenaDrone.com/)

ZenaDrone Inc. is dedicated to improving intelligent unmanned aerial vehicle (UAV) technology incorporating machine learning software and AI. It was created to revolutionize the hemp farming sector and later evolved into an intelligent multifunctional industrial surveillance, inspection, and monitoring solution.

About Epazz, Inc.

Epazz, Inc. is a mission-critical provider of Metaverse solutions, blockchain cryptocurrency mobile apps, and cloud-based software. It is a company that specializes in providing customized cloud applications to corporate firms, higher-education institutions, and the public sector. Epazz is developing Metaverse business solutions, enabling people to collaborate through VR in real-time. Epazz is upgrading its business solutions to be fully integrated into the Metaverse. Epazz will be manufacturing low-cost smart glasses for Metaverse.

Safe Harbor

Certain statements contained in this press release are "forward-looking statements," as defined by the "Safe Harbor" statement in the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally can be identified by their use of forward-looking terms such as "may," "expect," "intend," "estimate," "anticipate," "believe," and "continue" (or the negative variations thereof). Such forward-looking statements are subject to risk, uncertainties, and other factors that could cause actual results to differ materially from those the statements imply. Investors are cautioned that any forward-looking statements are not guarantees of future performance and that actual results may differ materially from those such forward-looking statements contemplate. Epazz assumes no obligation, does not intend to update these forward-looking statements, and has no duty to update or correct information that third parties not paid for by Epazz prepare.

Investors are encouraged to review Epazz's public filings on SEC.gov, including its unaudited and audited financial statements, its registration statement, Form 10-Ks, and Form 10-Qs, which contain general business information about the company's operations, operations results, and the risks associated with the company and its operations. Penny stock picks need to be researched. Do your homework. Please review all our filings.

For more information, please get in touch with the following:

Epazz Inc.

Investor Relations

investors@epazz.net

(312) 955-8161

www.epazz.com/investors.aspx

Following a successful collaboration with the US Air Force in SBIR Award Phase 1, ZenaDrone has gained significant traction in acquiring additional contracts valued at $1.2 million

CHICAGO, IL - (NewMediaWire) - February 07, 2024 - Epazz, Inc. (OTC Pink: EPAZ), a mission-critical provider of drone technology, blockchain mobile apps, and cloud-based business software solutions, has announced today that its holdings company ZenaDrone, Inc., a company known for its multi-patented drone technology, is excited to announce flight demonstrations of ZenaDrone 1000 with several units of the US Air Force. The flight demonstrations are instrumental for ZenaDrone to obtain memorandums of understanding (MOUs), which are essential to winning up to $1.2 million for the SBIR Phase 2 contract.

Following a successful collaboration with the US Air Force in SBIR Award Phase 1, ZenaDrone has gained significant traction in acquiring additional contracts. SBIR Phase 2 funding aims to continue the research and development commenced in Phase 1, focusing on the implementation and commercial viability of the ZenaDrone 1000.

Federal agencies administering the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs allocate significant resources to support small businesses in the research and development (R&D) sector. The intentional design of these phases pushes pioneering businesses like ZenaDrone to the forefront of defense technology innovation.

"We've been showcasing ZenaDrone 1000 in several and continuous flight demonstrations, which gained critical support from the US Air Force and US Defense Department personnel. Our team is working diligently to exceed the expectations of the Phase 1 initiative and move seamlessly into the execution of Phase 2, driving our mission to contribute to the safety and efficiency of defense operations," commented Shaun Passley, Ph.D., CEO of Epazz, Inc. and ZenaDrone, Inc.

These demonstrations are vital for the proposal of Phase 2 and will also cement the position of ZenaDrone as a leader in advancing drone technology within military applications.

The demonstrations have been meticulously planned to provide an in-depth view of the capabilities and advancements integrated into the ZenaDrone 1000. The success of these events is expected to pave the way for future research, development, and potential deployment, marking a milestone achievement for ZenaDrone and its dedicated team.

The intended audience includes defense technology enthusiasts, military industry professionals, and aviation media outlets who have been closely monitoring the progression of ZenaDrone's involvement with the US Air Force.

For further information about ZenaDrone, Inc. and its commitment to innovative drone technology, visit www.zenadrone.com.

About ZenaDrone Inc. (https://www.ZenaDrone.com/)

ZenaDrone Inc. is dedicated to improving intelligent unmanned aerial vehicle (UAV) technology incorporating machine learning software and AI. It was created to revolutionize the hemp farming sector and later evolved into an intelligent multifunctional industrial surveillance, inspection, and monitoring solution.

About Epazz, Inc.

Epazz, Inc. is a mission-critical provider of Metaverse solutions, blockchain cryptocurrency mobile apps, and cloud-based software. It is a company that specializes in providing customized cloud applications to corporate firms, higher-education institutions, and the public sector. Epazz is developing Metaverse business solutions, enabling people to collaborate through VR in real-time. Epazz is upgrading its business solutions to be fully integrated into the Metaverse. Epazz will be manufacturing low-cost smart glasses for Metaverse.

Safe Harbor

Certain statements contained in this press release are "forward-looking statements," as defined by the "Safe Harbor" statement in the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally can be identified by their use of forward-looking terms such as "may," "expect," "intend," "estimate," "anticipate," "believe," and "continue" (or the negative variations thereof). Such forward-looking statements are subject to risk, uncertainties, and other factors that could cause actual results to differ materially from those the statements imply. Investors are cautioned that any forward-looking statements are not guarantees of future performance and that actual results may differ materially from those such forward-looking statements contemplate. Epazz assumes no obligation, does not intend to update these forward-looking statements, and has no duty to update or correct information that third parties not paid for by Epazz prepare.

#Zenadrone #DSEI2023 #dronetechnology

#Zenadrone #DSEI2023 #dronetechnology

Lithium-Ion Batteries:

Best Batteries for the Modern World

Galaxy Batteries is committed to revolutionizing the energy landscape with our eco-friendly and sustainable solutions. Our primary focus lies in delivering lithium iron phosphate (LFP) based cathode batteries renowned for their superior performance and reliability. These advanced batteries offer unrivaled dependability, exceptional chemical stability, and seamless integration with state-of-the-art technologies. We take immense pride in expanding our product range to include ternary-based cathode batteries, further strengthening our position as industry pioneers.

Galaxy Batteries offer first-of-its-kind serviceability and unparalleled reliability in the market. Our lithium-ion batteries are future-proof that enables customers to save money, increase their energy security, and reduce hazardous emissions from industrial operations.

Our team of experts is committed to developing a new benchmark for lithium-ion energy storage. Our objective is to enable the wide-scale implementation of our cutting-edge technology, making clean, renewable energy accessible to everyone.

The industry's top lithium-ion batteries are supported by a team of seasoned scientists committed to delivering an outstanding customer experience. Our technical sales specialists can answer any questions about installs or what will function best in your system. Our experts will offer the knowledge required to get the most exemplary system for your requirements. We form our team with this foundation:

Quality comes first for all our products. To ensure that our customers are satisfied with our service and goods, Galaxy Batteries constantly evaluates and enhances our management, people, and processes systems. We accomplish this in various ways, including client surveys, internal audits, and industry benchmarking.

To ensure that we follow all our customer's and authorities' requirements, Galaxy Batteries conducts regular performance and safety tests.

ZENADRONE UPDATES:

Drone technology provides endless practical uses to various industries. Hence, commercial drones’ customizability adds more functions and features that make it easier to understand, access, and operate. The ZenaDrone 1000 combines innovative software and robust hardware design. Its functionalities can streamline inspection and monitoring processes, save field technicians from hazardous work, reduce workforce and operational costs, automate and perform tasks efficiently, and complete tasks that may be difficult or impossible for humans to do.

While the commercial drone industry is still at its infancy stage, UAV manufacturing companies are racing to build out, conduct flight missions, and prove their drone uses to conform to current and long-term regulations. The ZenaDrone 1000 has successfully carried out flight tests and aerial surveillance on vast plantations in Ireland.

It comprises innovative software technology and compact hardware components designed for industrial uses in construction, agriculture, surveillance, search and rescue, environmental inspection, and customizable functionalities.

ZenaDrone 1000 is an intelligent unmanned aerial vehicle (UAV) that incorporates machine learning software and artificial intelligence (AI). It was created to revolutionize the farming sector and later evolved into a multi-functional industrial smart drone. It aims to provide the public and private organizations with complete drone service solutions, especially in the Military and Police aerial scanning and surveillance operations.

We can provide different sectors across industries with comprehensive set of drone services that perfectly suited to the organization’s business operations. We can customize the drone attachments and components to meet each company’s drone innovation specifications.

Take advantage of the ZenaDrone smart industrial surveillance solutions. Please include your contact information and a brief description of your inquiry. We will contact you as soon as possible.

You can rent the Zenadrone 1000 for its scanning and surveillance services. You can buy the drone, rent it for a period, or share the drone with your industry colleagues. Hence, you can also choose the frequency of flight tests and subscribe to our scanning solutions. Our drone engineers will assist you in capturing aerial footage and transferring these pieces of data to your company’s cloud storage or computer hardware.

Contact us today and schedule a field scanning session.

ZenaDrone has eight (8) propellers that provide greater lift, enable it to move faster, and allow greater stability while in the air.

ZenaDrone is capable of vertical take-off and landing (VTOL), can hover steadily, and requires less horizontal space to launch.

ZenaDrone’s frame, body, and mounting plates consist of robust composite carbon fiber for a durable drone.

ZenaDrone plant tracking technology uses a wireless charging pad that detects the source of power automatically.

ZenaDrone can monitor, track, and scan objects, people, places, and animals using its multispectral sensors.

ZenaDrone has a built-in and long-lasting battery for extended and uninterrupted flight time.

Experience Zenadrone Inc. in action! Fill out the form below and our team will be in touch to set up a demo schedule.

EPAZZ ROAD MAP 2022 #Meta

As the metaverse grows, so too will its potential as a marketing platform. Metaverse marketing is becoming increasingly popular as businesses seek to reach a wider audience in the virtual world. In a completely immersive environment, businesses can acquire deeper insights into their customers’ consumption trends by tracking how they react to different products and services. With this information, they can then enhance various marketing campaigns or strategies accordingly and create better branded virtual experiences for your customers. The possibilities of metaverse marketing are endless—and some brands are already doing this!

Nikeland, for example, is a breathtaking metaverse store where visitors can not only try on their favorite sneakers but also play soccer and basketball games and hang out with other users. As of August 2022, Nikeland has obtained close to 19.6 million visits! Similarly, the Italian fashion brand Benetton has set up a metaverse store where users play games to earn QR codes that they can use in the brand’s physical stores.

All things considered, marketing your offerings in the metaverse is a great way to increase brand awareness and engage with your customers!

Apart from offering business owners the chance to be more marketing-savvy, the metaverse will also be a platform promoting efficient remote work. The metaverse office allows us to meet with clients from all over the world, work with remote team members and train and onboard new employees without the limitations of physical distance. This would greatly reduce the cost of doing business and operations, which will especially benefit startups of smaller sizes.

As teams explore new ways to work remotely while remaining engaged with colleagues and their creative process, metaverse collaboration working environments will become more popular. Accenture, for example, has created “The Nth Floor”, a metaverse environment that resembles real-world offices to offer employees and new hires the chance to conduct HR-related tasks and work together virtually.

A number of extended reality (XR) technologies have hit the consumer market in recent years, such as virtual reality (VR), augmented reality (AR) and mixed reality (MR). Tech giants are already racing to take advantage of this market.

In the coming year, Meta (formerly Facebook) will launch its second consumer-grade VR headset, a follow-up to the Quest 2, after rolling out the US$1,499 Quest Pro just two months ago. Microsoft, Apple, Google and many other tech companies are also working towards releasing their own new VR/AR/MR headsets.

In addition to headsets, we can also expect new developments in other accessories that take the immersive experience up a notch. For instance, on top of your VR headset, you might be able to go on a metaverse date wearing a haptic glove to feel the warmth when your date holds your hand!

Several startups, like OVR Technology, are even experimenting with technology that allows virtual experiences to be enhanced with smells. “What we wanted to do was, as accurately as possible, recreate how we experience smell in the real world in the virtual world,” said OVR’s CEO and co-Founder Andrew Wisniewski.

Besides offering users a multisensory virtual experience, the adoption of VR and AR in the manufacturing process might also witness a rise in the upcoming years. For instance, German vehicle manufacturer BMW is already using AR tech to design and prototype new products. It allows engineers to visualize geometrical concepts on true-to-scale holographic 3D models of the prototype vehicles, facilitating the assembly process and the experimenting of concept variants for future series vehicles.

In addition, with the advancement of AR and VR technologies, consumers will have greater access to the metaverse. With AR/VR technology, users can interact with virtual 3D objects even without wearing a headset. Disney, for example, is developing AR experiences at its theme parks.

Overall, the future of metaverse trends looks bright! We’re seeing innovation and progress from all angles, from marketing in the metaverse to the growth of AR/VR products. What we discussed today are just a few of the exciting trends that will be coming our way in 2023 and beyond. As more companies begin investing in immersive technologies, we can expect an even brighter future for the metaverse space. It’s definitely an exciting time to be involved with the metaverse!

As of March 28, 2024 • 12:41 PM ET

As of March 28, 2024 • 12:41 PM ET

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |