Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

😂🤣...."soon" ...."any day now"...🤣

Hey how’s the reverse triangular merger with a company whose NOLs are dwarfed by its debt looking??

LCY will showcase its products made with ITS OWN technology as it purchased it through LCYB back in 2018.

None of it has anything to do with Formerly Known As BioAmber or the former shareholders still clinging to their worthless shares and a lie of good things coming.

You must know that amusement is really all that is left, right?

Lcy will showcase its products made with Bioamber's technology, April 23-26, in China

https://www.chinaplasonline.com/

https://www.chinaplasonline.com/eMarketplace/exhibitorinfo/eng?compid=1029644&menu=service&Tab=products

Worthless just like every other day since the trading stopped forever back in 2019

Not even close to being accurate - just posting more nonsense void of facts.

BioAmber's CUSIP number 09072Q106 is no longer active. BioAmber filed for bankruptcy protection in 2018 and was subsequently liquidated under the Canadian Companies' Creditors Arrangement Act (CCAA).

The key points regarding the status of BioAmber's CUSIP are:

BioAmber ceased operations in August 2018 after failing to secure additional financing.

In November 2019, the Financial Industry Regulatory Authority (FINRA) officially suspended BioAmber's CUSIP registration, indicating the shares were worthless.

FINRA deleted BioAmber's ticker symbol on November 21, 2019, marking the completion of the company's liquidation.

PricewaterhouseCoopers (PwC), the court-appointed monitor, confirmed in a February 2019 report that BioAmber's common shares had no value and would be cancelled.

Therefore, while 09072Q106 was previously BioAmber's active CUSIP number when it was a publicly traded company

09072Q106 is no longer a valid identifier following BioAmber's bankruptcy and dissolution.

But you keep believing that the Supreme Being - will provide divine intervention and circumvent the Bankruptcy laws and provide those that invested more than you could afford to lose with a windfall of money. LMAO!

The true believers are hilarious.

Biowin will post press releases or articles from 2014 - plus articles that have absolutely nothing to do BIOAQ stock.

IG

Majority holding strong. Good night shareholders !!

Hey how’s the reverse triangular merger with a company whose NOLs are dwarfed by its debt looking??

Your star lawyer is FUD'ng an OTC stock board again. Come get your boy cassels. 🤣

They don't have anything factual to back up their nonsense.

This is all they can resort to.

By using Bioamber's technology

https://www.sustainableplastics.com/news/natureworks-launches-pla-coffee-pod-keurig-brewers

https://tw.linkedin.com/company/lcy

What?

Saying the last ever press release 6 years ago with nothing since means I am drinking scotch?

Honestly what are you doing?

are u sucking down scotch with the pirate

The last press release from the company 6 years ago is BS?

All I can agree is that your nothing but a BS Broken Record SMH

with an Agenda!

Agree!

You’re out one hundie!!

Positive about what?

That they lied in ‘18?

That CUSIP is attached to a deleted ticker.

Someone is a lunatic for saying that?

6 years later, no employee, no assets, no filings since ‘18 - what are you doing?

Cusip 09072Q106 Bioamber

Stay positive!!!

Ignore the lunatic.

The posts you dislike are only responses to insanity. No insanity, no posts.

Got it?

GM time to start posting! You guys are slowing down!

Yes, any mention whatsoever of a reversal 6 years later is totally moronic.

Hey Fear,

How’s the false hope business? Year 6 almost here! Gives you time to plan whatever commentary at years 7 and 8.

May sound silly but as you know they’re coming.

Aren’t all holding because they can’t sell?

Good morning shareholders & am shift 🐍$BIOAQ

Good morning bioamber shareholders !!

Majority holding strong!!!

Ugh I’ll just respond again to that puts. If that pathetic poster ever has anything, then I’d love to kill it,

Agreed, at least 2 different posters.

bot, I tried explaining logic with you once before and it's waaaaaaay over your head. Why bother. You obviously struggle with reading comprehension too. Surprisingly however, your lexicon and writing mechanics are wildly polar! It seems like sometimes it's one person and someone else another day of posts. And what an oddly specific definition of "an accepted bitter investor" I wonder how often you dream of it. Do bots dream? 🤣 Ok I jest. I'll stop calling you a bot if you tell me the last book you read...

How's that CCAA liquidation process working out for you?

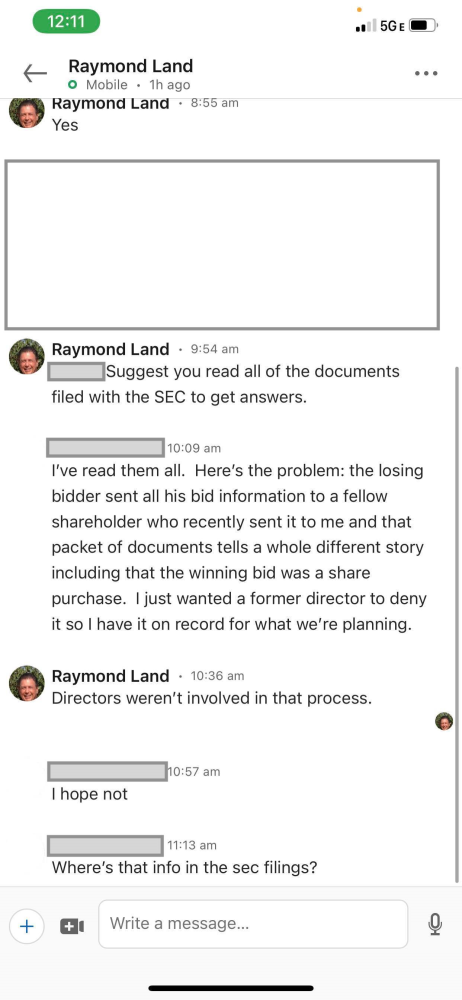

The 10th report is not believeable and equally not believable is someone being interested in what it will take for a bitter investor to accept the outcome presented in the 10th report (and all since the 6th) 6 years ago with nothing since?

Yes everyone is still on the CCAA liquidation process. That’s what happened.

It’s just as believable as “seeing what it takes”… they didn’t care about the investing public, neither do you.

Oh 8500+ post later and you're still on the CCAA LIQUIDATION PROCESS...ok keep up the good work I guess..

a replacement? When did it get replaced? Any announcement on that?

I see you didn't leave the board.

That’s literally what it was and the monitor told you that in its 10th report, which obviously you either didn’t read or are just not a fan of for obvious reasons.

“Protect the investing public”… hahaha

WHAT!! 8564 POSTS? Holy mother of paid bashers$BIOAQ

Those aren’t the same. With Bioamber gone that’s a replacement.

It truly is over, not like it is necessary to say that with what happened 6 years ago and nothing since.

Clearly not. The outcome was announced almost 6 years ago, which was liquidation. Ticker deletion came later but was just an administrative matter at that point.

Hmmm..so you're saying ticker deletion was 6yrs ago...???

No I don’t own any shares that’d be insane! It was liquidated!

I what to know what it will take.

I think we’ve identified your issue, in that you are stating “4 and 1/2 years” as when this went down, when in fact the outcome was clear 6 years ago. That was the main event, the ticker deletion was just a formality to protect the investing public.

Actually I was wondering why you have 8561 posts 4 1/2 years after ticker deletion?? How many shares do you own again???

You must mean LCYB. Bioamber is out of business, though as you know LCYB paid for the right to do business as Bioamber as appropriate.

Wondering what you thought would have changed 5 years after a ticker deletion.

Bioamber will fix the plastic problem around the world with bio degradable plastics

https://www.cbc.ca/news/climate/plastic-waste-negotiations-1.7179103

https://www.canada.ca/en/environment-climate-change/news/2024/04/canada-brings-the-world-together-in-pursuit-of-an-ambitious-global-deal-to-end-plastic-pollution.html

Just checked, annnddd stttiiillll.........

|

Followers

|

408

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

143483

|

|

Created

|

04/26/13

|

Type

|

Free

|

| Moderators Homebrew Lucky77Dice randomwalk007 Real McCoy dalesio_98 iron-eagle | |||

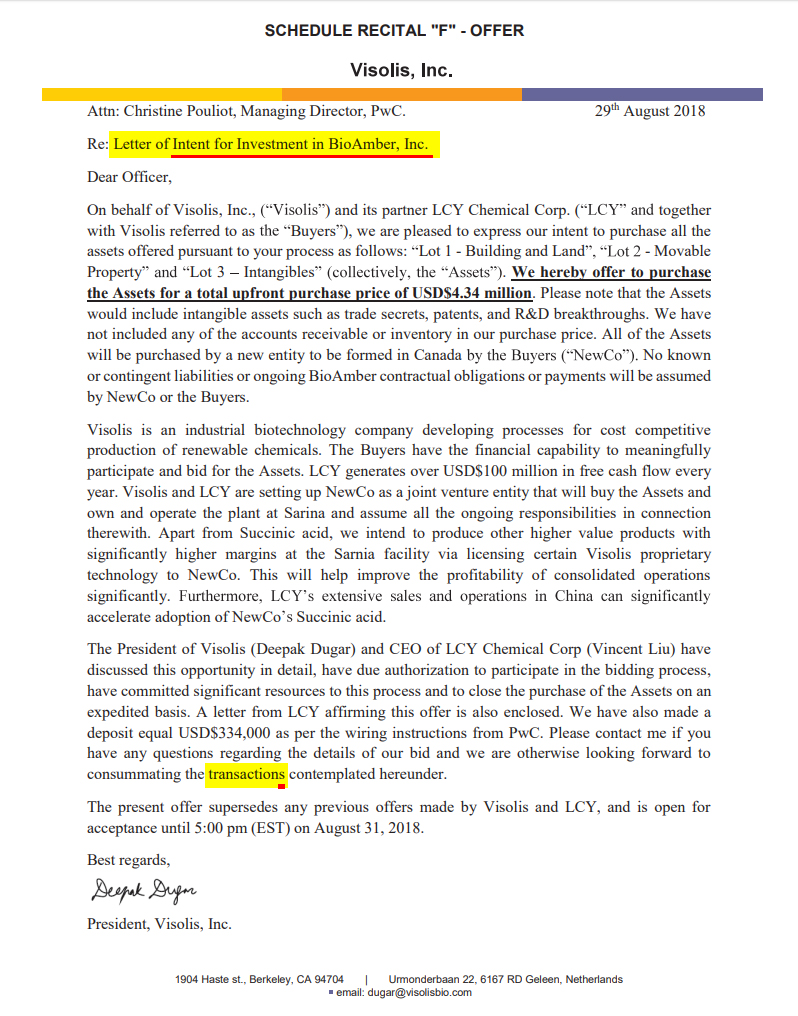

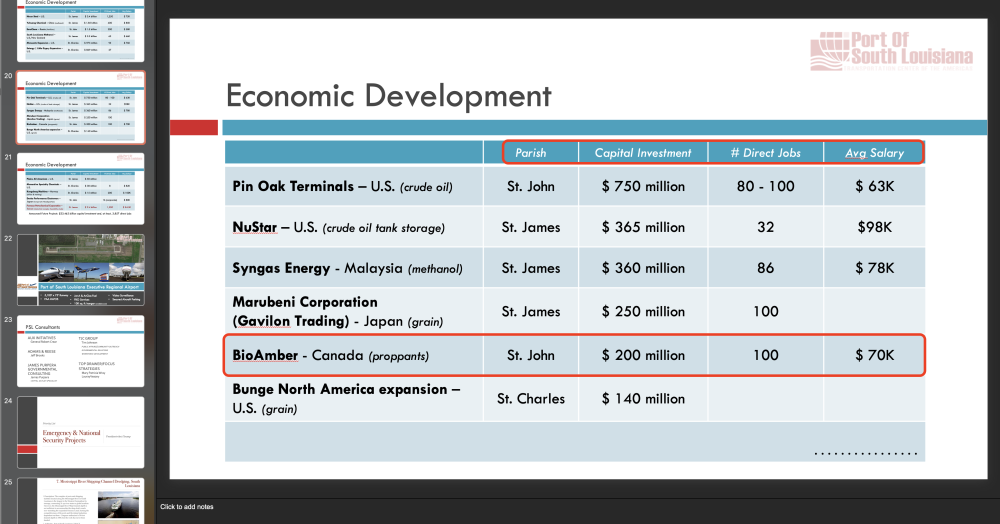

BioAmber completed the CCAA proceedings (Companies Creditor's Arrangement Act), on December 23, 2019 upon the filing of the Discharge Certificate. Under CCAA, (Canada law, not US) BioAmber was not in liquidation, receivership, or bankruptcy. Learn more about CCAA here. The monitor was PwC (PriceWaterhouseCoopers) with extended powers from the Canadian court, and facilitated sales transactions with Visolis and LCY Chemical Corp, which together formed the joint venture LCY Biosciences "LCYB", the designated purchaser that purchased and will now continue to operate the Sarnia plant. These transactions must include both assets of the Companies and shares of BioAmber Inc. (the US Parent company), in a multi-step transaction, which aims to take advantage of BioAmber's IP, trade secrets, patents, R&D breakthroughs, Vinmar contracts, and tax benefits of BioAmber's NOLs.

LCY Chemical itself was just recently purchased by KKR in a 1.5 billion dollar acquisition, whereby LCY Chemical Corp is now a private company. Learn more about that transaction here.

PwC's various updates can be found on their website here.

PWC RELEASES AUGUST COURT MOTION ON FEBRUARY 14, 2019 - CONFIRMS SALE FOR

====================================================================================

FEB 8, 2019 Evening Update

NEWS !! PWC Updates Shares Worthless, FINRA Notified

Stick a fork in BIOAQ's common shares. They are DONE.

Today's Tenth Monitor's Report, issued by PwC specifically to dispel the internet rumors of the common shares having value, proves the common shares are not only worthless, but will be cancelled.

See Sections 16, 18, 19 below.

http://www.pwc.com/ca/en/car/bioamber/assets2/bioamber-049_020819.pdf

Anyone holding the common shares when FINRA (who has been notified by PwC) will lose 100% of their investment. Assuming they have a chance to sell, of course. FINRA could decide to delete the ticker at any time from this point forward.

=====================================================

IMPORTANT NOTICE !!

Company Liquidation is COMPLETED

Ticker Deleted by FINRA on 11-21-2019.

They will no longer exist for trading.

|

Posts Today

|

0

|

|

Posts (Total)

|

143483

|

|

Posters

|

|

|

Moderators

|

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |